Tim Tam is currently the only Arnott’s brand that is available in the US, and is distributed through Connecticut-based commercial bakery Pepperidge Farm. Both Pepperidge Farm and Arnott’s are owned by the Campbell Soup Company.

“In 2009, we conducted a test-and-learn under Pepperidge Farm in very limited distribution [of Tim Tam],” director of adult snacking at Tim Tam US and Pepperidge Farm, Scott Utke, said.

“Since then, we’ve applied the learnings from our go-to market needs and the strength of Tim Tam as a global brand. This proper US introduction is the next step in taking this authentic Australian cookie global.”

Before joining the Pepperidge Farm team, Utke previously worked for the confectionery firm, the Topps Company, and Kraft Foods, according to his LinkedIn account.

Exclusive flavor for US consumers

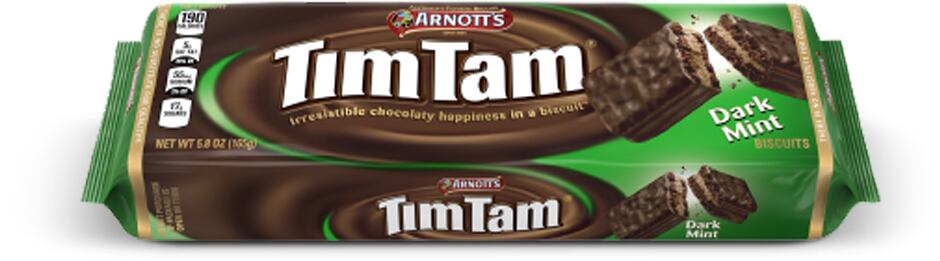

Tim Tam biscuits are available in four varieties in the US: Original, classic dark, chewy caramel and dark mint. All of the varieties are available at major supermarkets, grocery stores and mass merchandisers nationwide for a suggested retail price of $3.49.

Utke said the dark mint flavor was designed exclusively for the US consumers after product research and learnings.

“While there are many consumers in the US market who are familiar with Tim Tam, we’ll focus on awareness and education,” he said. “This is a big part of what will make Tim Tam successful, both from a packaging standpoint as well as via communications.”

Not affected by President Trump’s decision on TPP

US President Donald Trump signed the executive action of withdrawing the US from Trans-Pacific Partnership (TPP) on Monday.

But Utke said, “There is already a US-Australia bilateral free trade agreement in place that eliminates tariffs on our products, separate from the TPP."

The US-Australia Free Trade Agreement (FTA) entered into force in 2005, and the US two-way trade with Australia was $26.6bn in 2009, according to the US government website.

Marketing plan to compete with major confectionery players

ConfectioneryNews has reported major confectioners have been developing snack products that target chocolate consumers in the past year.

For example, Hershey developed a range of cookie layer crunch products in December 2016, shortly after Mondelēz planned to tackle the US chocolate market alone with Milka Oreo and Green & Blacks, following a failed bid to acquire Hershey.

In the US cookies category alone, Oreo maker Mondelēz has posted total dollar sales of over $3bn, making it the category leader, according to IRI data that includes the total US multi-outlets with c-store for the latest 52 weeks ending Aug 7, 2016.

Meanwhile, Pepperidge Farm posted total dollar sales of around $375m in the category compared to Kellogg's $591m, during the same period.

Asked how Tim Tam would compete with major US confectionery players following the product launch, the company said it has developed a marketing plan that will build awareness and trial with new consumers as well as appeal to current followers, who are mainly Australians living in the US, Utke mentioned.

“Our new ‘It’s not a cookie, it’s a Tim Tam’ campaign will help to drive differentiation from the category, generate intrigue and drive purchase interest.”

“With nearly 50% of all eating occasions in the US being snacks, Tim Tam is a huge growth opportunity for us,” he added. “We will continue to innovate to meet our consumers’ needs and be part of their everyday moments.”